In today’s fast-paced business world, organizations constantly seek innovative solutions to streamline operations and improve efficiency. One challenging area for every organization is accounts payable, where manual processes can be time-consuming, error-prone, and redundant, hindering productivity and impacting business growth. However, with the advent of Robotic Process Automation (RPA), companies now have a powerful tool to transform their accounts payable department. In this article, we will explore how RPA can revolutionize your accounts payable processes, enhance accuracy, save time, and ultimately optimize the overall financial management of your organization.

Why does your organization need automation in Accounts Payable?

As vendors, we hate delayed payments and errors in tax deductions at source. Our finance teams are often at loggerheads with the invoicing teams of our clients, modifying invoices or recommending changes to ensure that payment processing runs smoothly. However, with the sheer amount of time spent on manual processes while sharing, approving, and processing every invoice, your organization must choose automation to boost your flexibility, adaptability and efficiency by implementing RPA in accounts payable.

What are the challenges faced by organizations in AP processing?

Except for time and cost savings, which are the major drivers for an RPA-based AP automation solution, here are some other problems that most companies face in their manual AP journey:

- Paper invoices and the need for filing

- Manual invoice routing and approval

- Errors in entries

- Lost or missing invoices

- Discrepancies in amounts payable

- No clarity on outstanding liabilities

- Problems during audit and compliance

In addition to this, companies also face other problems, such as the lack of a competent workforce, compliance with local laws and many more. All these problems eventually lead to vendor dissatisfaction, stunted organizational growth and potential problems with investor faith.

Understanding RPA and its Benefits

Robotic Process Automation (RPA) is a technology that uses software robots or “bots” to automate repetitive and rule-based tasks. When applied to accounts payable, RPA eliminates manual data entry, invoice processing, and payment reconciliation, among other time-consuming activities. By leveraging RPA, companies can benefit from increased accuracy, enhanced efficiency, reduced costs, and improved compliance. These robots can work 24/7, ensuring round-the-clock processing and faster turnaround times, increasing customer and vendor satisfaction.

Streamlined Invoice Processing

One of the most significant challenges in accounts payable is invoice processing. Traditionally, it involves manual data extraction, verification, and entry into the accounting system. RPA streamlines this process by automatically capturing data from invoices, cross-checking information against purchase orders and receipts, and initiating approvals. With RPA, businesses can achieve near-perfect accuracy, eliminating errors caused by manual data entry and reducing the need for human intervention. This not only saves time but also minimizes the risk of costly mistakes.

Automated Payment Processing and Reconciliation

RPA can also automate the payment processing and reconciliation tasks which are critical components of the accounts payable workflow. Bots can securely access banking systems, generate payment files, and initiate transactions, ensuring timely and accurate vendor payments. Furthermore, RPA can reconcile payments against invoices, identify discrepancies, and resolve issues without human intervention. By automating these processes, companies can accelerate payment cycles, prevent late fees or double payments, and improve cash flow management.

Enhanced Compliance and Auditability

Compliance and audit are crucial aspects of accounts payable. RPA is vital in ensuring adherence to regulatory requirements and internal controls. By automating routine tasks, RPA reduces the risk of fraud, improves data security, and maintains a comprehensive audit trail. The software robots can log every transaction, capture relevant data, and generate reports for audit purposes, enabling organizations to demonstrate compliance with legal and financial regulations. Additionally, RPA provides greater transparency, making tracking and tracing every step of the accounts payable process easier.

Better Supplier Relations

As you process invoices faster and with minimal delays, you minimize the chances of duplicate invoices and invoices getting lost. This also helps organizations maintain their credit line and work towards credibility, stability, and growth. Vendors paid in time help organizations scale better with better credit lines and repayment schedules.

How can Clavis Technologies help?

With our extensive experience in AI, RPA, automation, and intelligent document processing across industry verticals, we can help your organization take its first steps towards intelligent AP automation. We train our dedicated RPA and AI teams to listen, understand and transform. This process helps us to grasp your needs, find the gaps that automation can plug, and transform your entire Accounts Payable or invoicing process for the better. Process automation frees up valuable resources that can help vet the output and help your organization scale better.

Final Thoughts

Robotic Process Automation (RPA) offers a transformative solution for streamlining accounts payable processes. By leveraging RPA’s capabilities, organizations can eliminate manual, repetitive tasks, significantly reduce errors, and increase efficiency. The benefits of RPA in accounts payable include streamlined invoice processing, automated payment processing and reconciliation, and better compliance. By implementing RPA, businesses can achieve higher accuracy, faster processing times, and more significant cost savings. As the demand for efficient financial management grows, embracing RPA in accounts payable becomes increasingly essential for companies seeking a competitive edge in today’s dynamic business landscape.

ERP vs CRM: Key Differences, Strengths, and How Clavis’ ERP Drives Organizational Success

In the digital age, businesses strive to leverage advanced tools to streamline operations, boost productivity, and foster better customer relationships. Two pivotal software solutions that play a significant role in achieving these goals are Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems. While these tools may seem similar at first glance, they serve distinct purposes and offer unique benefits, and it is important to understand why you may need one or the other—or both in tandem.

1. What is ERP?

ERP stands for Enterprise Resource Planning, a comprehensive software suite that manages and integrates core business processes. These processes often include:

- Finance and accounting

- Human resources

- Supply chain management

- Inventory and order management

- Manufacturing

ERP systems centralise business data, allowing various departments to collaborate seamlessly and make informed decisions based on real-time insights.

Core Features of ERP Systems

- Centralized Data Management: Consolidates information from all business departments into one platform.

- Process Automation: Automates repetitive tasks to improve efficiency.

- Scalability: Can grow with your business, accommodating new functionalities as needed.

- Compliance Support: Helps organisations meet regulatory requirements.

- Advanced Analytics: Provides detailed insights to support strategic decision-making.

2. What is CRM?

CRM, or Customer Relationship Management, is software that focuses on managing a company's interactions with current and potential customers. The primary goal of a CRM system is to improve customer satisfaction, retention, and acquisition through personalised communication and efficient management of sales and marketing activities.

Core Features of CRM Systems

- Contact Management: Maintains detailed records of customer interactions and preferences.

- Sales Pipeline Tracking: Manages leads and monitors the sales process.

- Marketing Automation: Facilitates email campaigns, social media management, and more.

- Customer Support: Enhances post-sale services through ticketing systems and live chats.

- Data-Driven Insights: Helps identify trends to fine-tune marketing and sales strategies.

3. ERP vs. CRM: Key Differences

While ERP and CRM are essential for business success, they cater to different aspects of operations.

|

Feature |

ERP |

CRM |

|

Primary Focus |

Internal processes and operational efficiency |

Customer interactions and relationships |

|

Key Functions |

Accounting, supply chain, HR, inventory |

Sales, marketing, customer service |

|

Target Audience |

Internal stakeholders |

Sales, marketing, and customer support teams |

|

Data Integration |

Focuses on consolidating operational data |

Specialises in customer-centric data |

|

Scalability |

Enterprise-wide |

Primarily focused on customer management |

4. The Strengths of ERP Systems

ERP systems are the backbone of operational efficiency. Their key strengths include:

- Holistic Business View: ERP provides a comprehensive view of business operations by integrating data across departments.

- Cost Reduction: Automating processes reduces manual labour and errors, saving time and money.

- Improved Compliance: Centralized data simplifies regulatory reporting and ensures adherence to standards.

- Inventory Optimization: Enhances inventory management, reducing waste and ensuring timely procurement.

- Agile Decision-Making: Real-time data insights help leaders make swift, informed decisions.

5. The Strengths of CRM Systems

CRM systems shine in the realm of customer relationship management, with benefits such as:

- Enhanced Customer Insights: Tracks and analyses customer preferences to tailor interactions.

- Improved Customer Retention: Personalization and timely communication foster loyalty.

- Streamlined Sales Processes: Automates lead management, reducing manual intervention.

- Marketing Optimization: Helps segment audiences for targeted campaigns.

- Boosted Collaboration: Facilitates alignment between sales and marketing teams.

6. ERP and CRM: Complementary Tools

Though distinct, ERP and CRM systems are complementary and often integrated to deliver maximum value. For instance:

- CRM manages the front-end relationship with customers, while ERP handles back-end processes like inventory and order fulfilment.

- Together, they provide a seamless flow of information, ensuring that customer-facing teams have accurate, up-to-date data on orders and services.

7. Clavis' ERP: The Ultimate Solution for Organizational Success

Clavis' ERP stands out as a robust ERP solution designed to address the multifaceted needs of modern businesses. Here’s how it can drive your organisation's success:

a) Comprehensive Integration

Clavis' ERP integrates seamlessly with existing systems, including CRM platforms, to unify your business processes.

b) Real-Time Data Analytics

With Clavis' ERP, decision-makers can access advanced analytics tools that offer actionable insights into performance, trends, and potential opportunities.

c) Tailored Functionality

Highly customisable to suit the unique needs of businesses across industries, Clavis' ERP works for all—from manufacturing to retail and more.

d) Enhanced User Experience

The platform boasts an intuitive interface, making it easy for employees to adopt and use effectively.

e) Cloud Capabilities

Leverage cloud-based deployment for flexibility, scalability, and cost savings.

9. Choosing the Right Solution for Your Business

When deciding between ERP and CRM—or opting for an integrated approach—consider the following:

- Business Goals: Identify whether your primary focus is operational efficiency (ERP) or customer relationships (CRM).

- Scalability: Choose a solution that can grow with your business.

- Budget: Evaluate the total cost of ownership, including deployment and maintenance.

- Customization: Ensure the platform can be tailored to your specific needs.

Final Thoughts

ERP and CRM systems are indispensable for businesses aiming to optimise operations and enhance customer relationships. While they serve distinct purposes, their integration offers unparalleled value. With Clavis' ERP, you gain a robust tool that streamlines your operations and integrates seamlessly with CRM systems to provide a holistic business solution.

Some other posts you might be interested in.

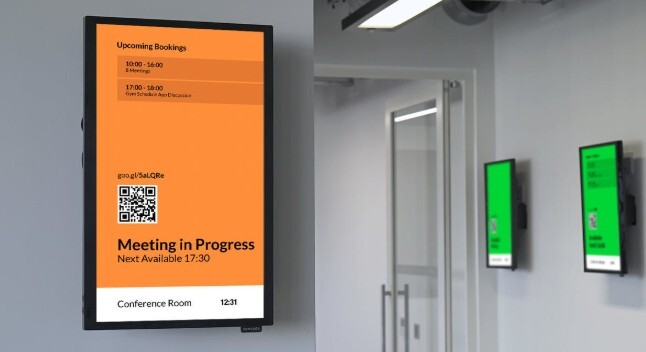

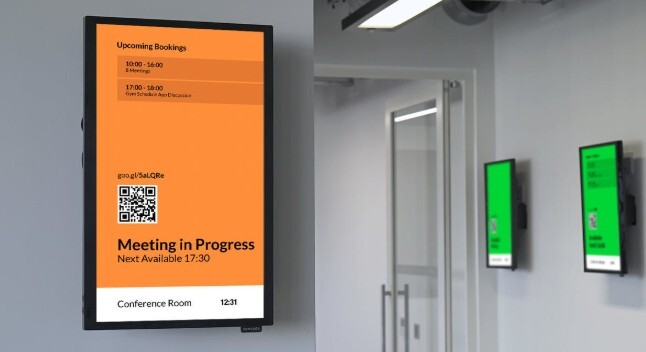

Effortless and Effective Digital Signage for Every Organization with Clavisign

Explore how digital signage from Clavisign is transforming business communication and engagement.

Effortless and Effective Digital Signage for Every Organization with Clavisign

Explore how digital signage from Clavisign is transforming business communication and engagement.

15 Applications of Blockchain in Healthcare

"Blockchain" refers to a shared irreversible record of a chain of transactions, each of which is made up of one block, and which is held together by cryptographic keys ("hashes"). These keys or signatures are maintained in shared ledgers and connected by a network of...